The Small Business Center (SBC) at Durham Tech provides startup and existing entrepreneurs (for profit and nonprofit) with the information and tools needed to develop business ideas to become viable, sustainable, profitable, and successful. Through the services provided by the the SBC, entrepreneurs receive assistance with several business areas including, but not limited to, business planning, marketing, legal, accounting, and financial management.

The Small Business Center (SBC) at Durham Tech provides startup and existing entrepreneurs (for profit and nonprofit) with the information and tools needed to develop business ideas to become viable, sustainable, profitable, and successful. Through the services provided by the the SBC, entrepreneurs receive assistance with several business areas including, but not limited to, business planning, marketing, legal, accounting, and financial management.

Sign up for our monthly newsletter to stay up-to-date with upcoming SBC events, funding opportunities, and business tools and resources.

Small Business Counseling

Free, one-on-one, confidential counseling sessions for new and existing business owners.

Small Business Seminars

A variety of free business skills seminars and workshops held at the SBC and webinars held online.

Resource Center at SBC

Books, magazines, and other literature on various business topics, industries, and the local community.

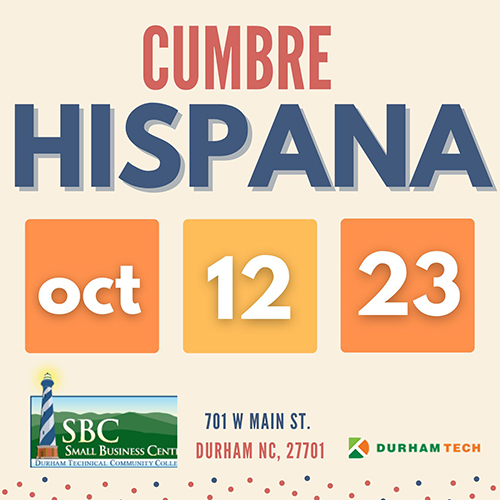

¡La Cumbre Hispana 2023 es la celebración de la Hispanidad en Durham!

¡La Cumbre Hispana 2023 es la celebración de la Hispanidad en Durham!

Únase a nosotros para un increíble evento, Cumbre Hispana 2023, que tendrá lugar en Chesterfield, West Main Street, Durham, Carolina del Norte, EE. UU.

Este es sun, gratuito evento para todos los miembros y entusiastas de la comunidad hispana.

La cumbre reúne a propietarios hispanos de pequeñas empresas, aspirantes a empresarios, representantes gubernamentales, expertos de la industria y partes interesadas de diversos sectores.